Award-winning PDF software

Form 8332 Virginia Fairfax: What You Should Know

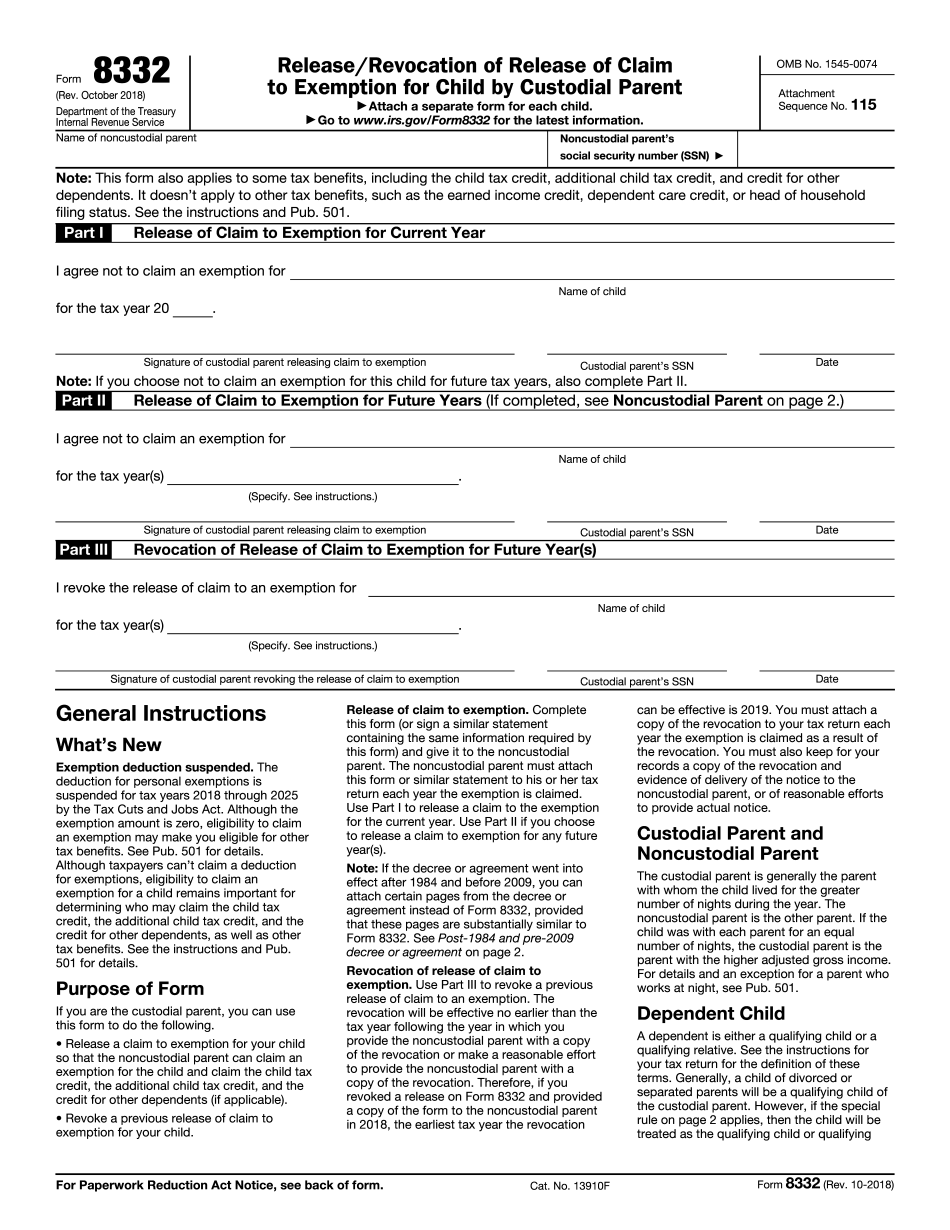

Tax-exempt charitable organizations may be exempt from personal property tax on donated property. To determine personal property tax rates, your own personal property tax information may be provided to the office of the local treasurer. If tax is owed on donated property, the amount due will be deducted from your state income tax refund. Tax Form | Fairfax County The child who was adopted or placed for adoption has the right to claim the child-sourced exemption. All qualified children of the child-placing parent in the filing spouse's household and all children of the filing wife (if the filing spouse is pregnant at the time of filing) can be exempt from this tax. There is a child-sourced exemption for adoptive and foster families. If you are married to someone who is a U.S. citizen, the tax-exempt status of that spouse depends on his or her permanent, bona fide residence in the United States. If he or she has no permanent, bona fide residence, the resident spouse is not a U.S. citizen who will be subject to federal taxes. Mar 1, 2025 — As the parent with custody—the mother, in most cases—you remain eligible, if you sign IRS Form 8332, which allows the 2025 exemption For more information, see IRS Form 8332 — Release/Revocation of Exemption for Child by Custodial Parent. Military members with Post Traumatic Stress Disorder (PTSD) are also entitled to the tax benefit provided by the Child and Dependent Care Tax Credit (CD CTC). To qualify for this credit, you and the other spouse are required to meet a certain income qualification threshold, such as a joint filing or earning income below the federal poverty line. If you do not qualify, you or the other spouse may be eligible for a tax credit equal to 50 percent of the total cost of any qualified childcare expense that you and the other spouse claim for yourself or one of your children. Qualified childcare expenses include regular day care services or any kind of special educational support for children. If you claim a tax credit for child care, the IRS will determine the child's qualified care expense deduction based on the child's adjusted gross income. The amount of the qualified education expense deduction will depend on the educational institution involved.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8332 Virginia Fairfax, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8332 Virginia Fairfax?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8332 Virginia Fairfax aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8332 Virginia Fairfax from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.