Award-winning PDF software

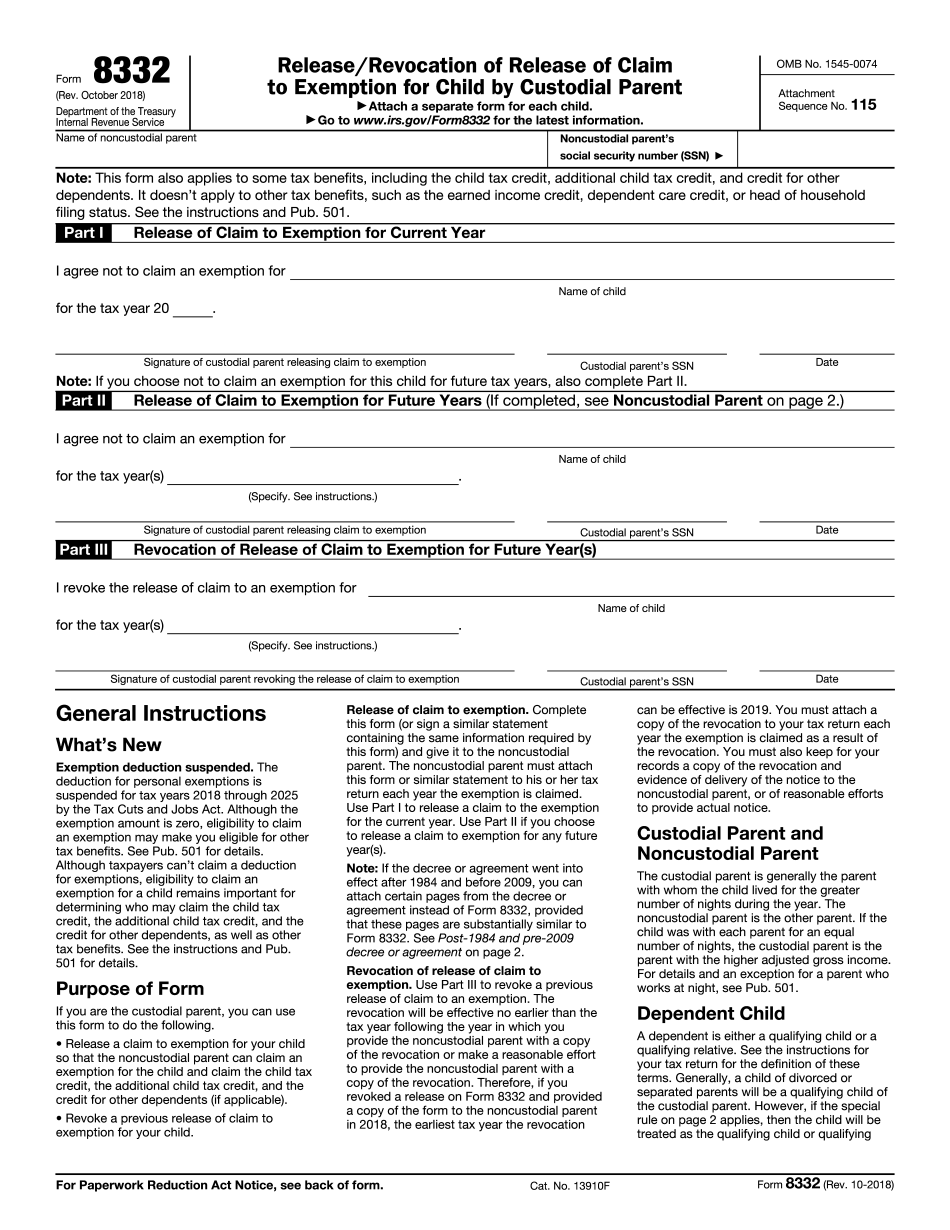

Printable Form 8332 Omaha Nebraska: What You Should Know

Com. Check your state's specific requirements before you start. Mar 10, 2025 — Here's a summary of everything you need to do as a business owner to help prevent tax evasion. Check with your state attorney general or a tax advisor before you do anything. Read the guidelines on your business' website. Mar 10, 2025 — Using FILE allows you to file electronically. For more information, visit eFile.com. Mar 10, 2025 — Use your FILE login for all of your online transactions. Mar 16, 2025 — Get ready to pay taxes on the sale of most items made from goods sold to you. Your state's sales tax rate may vary. Here's how. Learn more. You can use FILE for credit card payments, too. Find tips and information here. Mar 16, 2025 — Find free resources if you're unemployed. Mar 20, 2025 — In-state tuition rates. Mar 20, 2025 — State income tax withholding. You must file federal income tax forms on your federal tax return, too. Here's how. Mar 23, 2025 — If you are eligible for the Earned Income Tax Credit, apply now by Jan. 1. Mar 30, 2025 — The Earned Income Tax Credit is a tax grant that can reduce your tax obligation. Read more. The IRS also maintains a page with more information on the ETC. Apr 7, 2025 — How to manage delinquent filers. Apr 28, 2025 — The refundable credits available on your tax return. May 3, 2025 — What to do if IRS audits and returns. May 14, 2025 — You must file for the child tax credit and the earned income tax credit if you are married, filing jointly, or both, even if your income is smaller than the amount you were required to file. Find out the rules for filing, how to file, and more. May 25, 2025 — Learn what states charge on the sales of lottery tickets. May 31, 2025 — What happens if you owe state income tax and don't respond to IRS notices. Jun 15, 2025 — The IRS has published new guidance for filing late payment tax returns for 2018.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8332 Omaha Nebraska, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8332 Omaha Nebraska?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8332 Omaha Nebraska aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8332 Omaha Nebraska from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.