Award-winning PDF software

Form 8332 for Moreno Valley California: What You Should Know

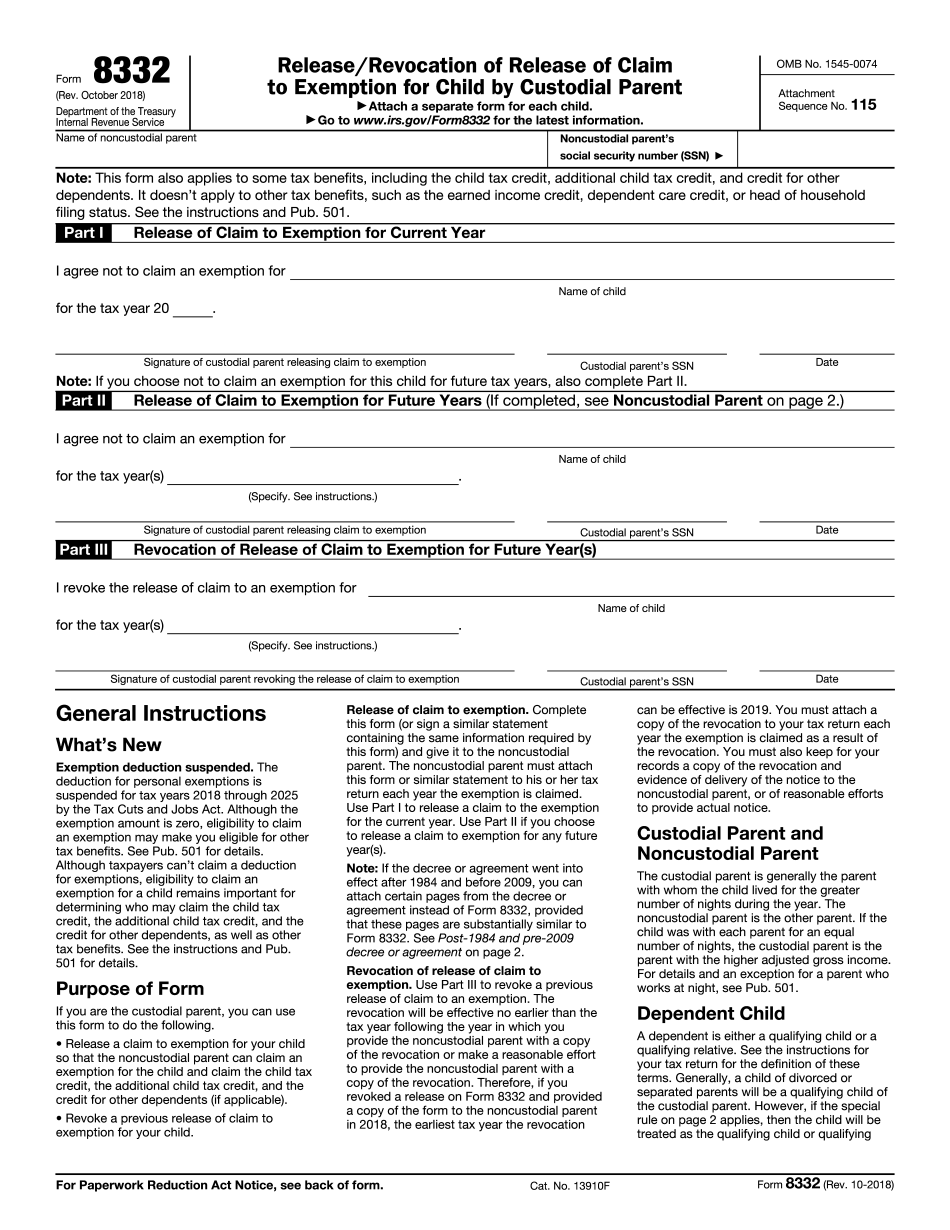

It covers this and a variety of other questions. If you are under the age of 21, the person being asked to release your claim of exemption is your custodial father or sheriff (your father, if you are the father) or notarized guardian (your mother). Release the claim of exemption: 1. Read or sign Form 8332 and have two witnesses sign the form. This can be done in your absence by anyone having the custody of the subject child. 2. Print Form 8332 and write the parent name on the back. If you don't have a printer, you can leave the form blank and the form can be mailed. You might need to get two copies if you mailed the form to the same person more than once (but even then, only one copy is needed). 3. Go to IRS.gov for online release of claim to information about Form 8332, Release of Claim and Exemption, including recent updates. The information is also posted at the National Parents Organization website. Submit the Form 8332: 1. Send or deliver a completed form with proper signatures (2) and the required fee to the Self-Help Center. 2. If you signed electronically, download and complete a copy of the release and send it. You do not have to get a third copy. (For other filing requirements) Send Form 8332: 1. Send Form 8332 (or sign a similar statement containing the same information required by this form) electronically to the National Parents Organization by clicking here. 2. Mail Form 8332 by mail to the Self-Help Center: Sealed, with Delivery Confirmation: Mail a self-help form (Form 8333) to the National Parents Organization, Inc., 3515 W. Lake view Ave, Ste. 120, San Francisco, CA 94129. The form must be received by January 2nd of the year following your birth if you filed your return with an income for your taxable year if your filing status is married filing separately (as of January 1, 2018); January 1st of the year earlier if your filing status is married filing jointly, and the return was filed after February 17, 2003. A Self-Help Form is filed with a copy of your original IRS Form 1040.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8332 for Moreno Valley California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8332 for Moreno Valley California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8332 for Moreno Valley California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8332 for Moreno Valley California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.